What Does an Economic Recession Mean for the Real Estate Market?

According to a recent survey, 70% of Americans are expecting a recession in 2022 (CNBC 2022), while 68% of the leading academic economists polled by the Financial Times are pinpointing an economic recession to happen sometime in 2023.

Regardless of if and when a recession will occur, many consumers may become concerned about the housing market and how a recession will impact buying a home.

According to Forbes Advisor, the leading factor that will keep the real estate market on a steady, upward trend is supply and demand. “‘The severely low supply is also helping fuel demand, and higher home prices, which is another reason why housing experts say the market will remain strong for years to come. The supply-demand imbalance is the primary reason home prices have escalated so rapidly,” says Rick Sharga, executive vice president at RealtyTrac. “And after not building nearly enough houses for the last decade, homebuilders will take several years at least to add enough new supply to balance the market.”’

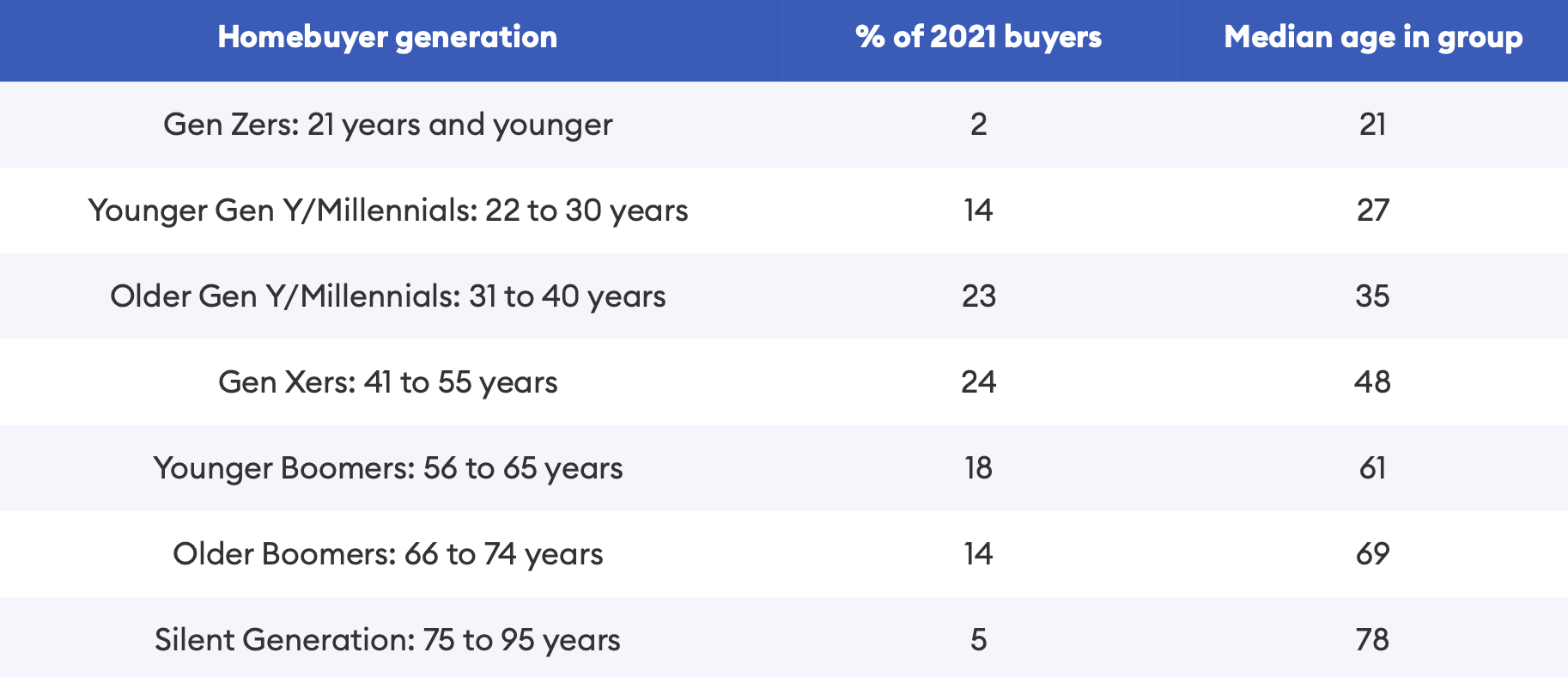

Millenials and Gen Z making up half of the U.S. population as of July 2019 “is significant because first-time homebuyers represent the largest share (31%) of people purchasing homes, according to data from the National Association of Realtors (NAR). And most first-time buyers are younger than 40, which means the buyer pool is deep–a good indication that demand will remain strong, especially since housing inventory is at historical lows. We won’t see a downturn because the housing market saw little increase in inventory for the past ten years. In a few years, Gen Z will be turning 30, and more financially ready to become homeowners than Millenials were at their age,” says Polina Ryshakov, senior director of research and lead economist at Sundae, a real estate marketplace for distressed properties. “This means that the demand for homes will be as high, if not higher, while inventory will still be behind in the demand’”(Forbes Advisor 2022).

(Source: National Association of Realtors)

Buying During a Recession

According to Investors Place, a recession may realign or slow the price incline of the real state market since there’s typically less consumer spending and “a recession will put upward pressure on lending rates that should dramatically reduce the demand for homes. This, by definition, should cool home prices. To what degree the housing market will ease, however, is up for debate. Some expect prices to drop in the face of a recession. Others foresee slowed price growth until home construction ramps back up. Despite this, a recession still wouldn’t exactly create a buyers market for homes. An economic downturn implies high mortgage rates, elevated costs of goods, and reduced wage mobility. While home prices may see relief, buying a house during a recession is still, well, buying a house during a recession.”

The Bottom Line

Home buyers are faced with difficult decisions in the current market, with demand being high and having a low supply of homes. Many economists not seeing a decrease in the U.S.’s real estate market can raise concerns for a future home owner.

Forbes Advisor recommends for some buyers, moving away from big cities into metropolitan areas can put less stress on their budgets. “For others, it means stretching their budget or compromising on size or other amenities. Some buyers are snagging a house now, even if it means sacrificing other purchases, [which] could mean saving money down the road if home prices and equity continue to rise. There’s a chance they could also save by getting a house and locking in a rate before both rates and home prices increase.” Forbes Advisor warns about the possibility of the market going down and buyers being stuck with an underwater mortgage, though they claim experts predict that is very unlikley to happen.

“Another important consideration in this market is how long you plan on staying in the home. People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs. Buyers who plan on moving in a few years are in a riskier position if the market plummets. That’s why it’s so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice” (Forbes Advisor 2022).

(Information provided on TheRealtyFirms.com is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. Please contact a mortgage professional or financial professional for mortgage or financial advice. We do not offer financial advice or fiancial advisory. Market performance information may have changed since the time of publication. Past performance is not indicative of future results.

To the best of our knowledge, all content is accurate as of the date posted. The opinions expressed, linked, and quoted are of the author’s own and publication site.)